Indian Stock Market Closes Lower Despite GST Reforms Buzz; Insurance Stocks Take a Hit

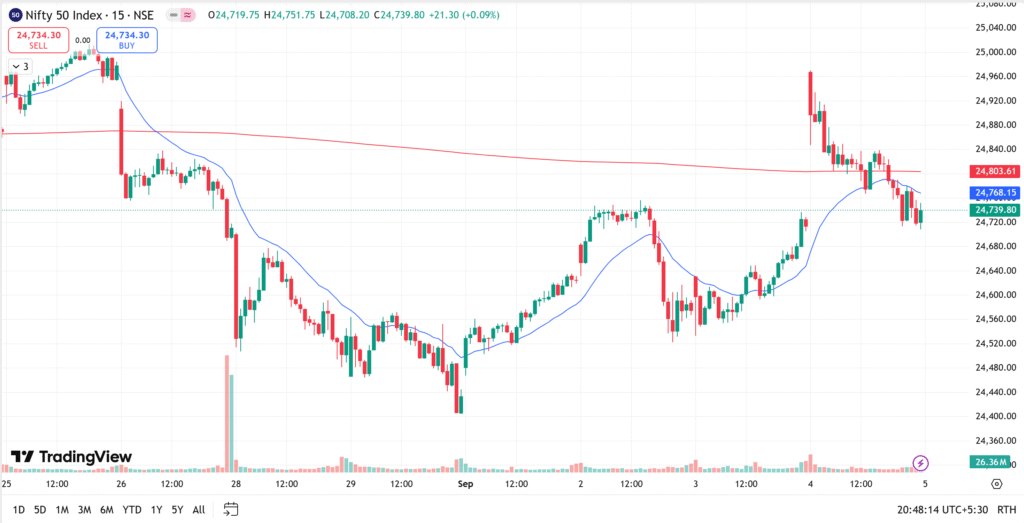

The Indian stock market ended on a weak note today, despite heavy discussions around the recently announced GST changes. The so-called “GST reforms” failed to lift investor sentiment, with both the Nifty 50 and Bank Nifty closing negative after early gains.

Market analysts pointed out that the measures, though presented as reforms, were more in the nature of adjustments rather than structural changes. “A true reform improves a broken system. Since GST itself was introduced by the current government, branding these tweaks as reforms may not be entirely accurate,” said one analyst.

Market Performance

- Nifty 50: Closed flat with a marginal 19-point gain.

- Bank Nifty: Ended near its 200-day EMA support, reflecting weak momentum.

- Midcap & Smallcap indices: Declined through the day after early optimism.

Profit-booking was evident from mid-morning, with FIIs and DIIs recording only modest net inflows of around ₹2,200 crore combined.

Sector Highlights

- Top Gainers:

- M&M (+6%) – auto stocks rallied as GST cuts on vehicles were advertised heavily, boosting consumer sentiment.

- Bajaj Finance (+4%), Apollo Hospitals, Nestlé India also posted gains.

- Top Losers:

- Ola Electric (–6.5%), Sharda Energy (–4.5%), Shipping Corporation (–4%), Data Patterns (–4%).

- Insurance stocks like HDFC Life fell sharply as reduced GST on premiums will not allow input tax credit, denting margins. Policybazaar also closed near the day’s low.

Broader Trends

Investors expressed caution, noting that a small reduction in car or bike prices is unlikely to significantly increase consumption in the long run. However, repeated promotion of “cheaper vehicles” by media could push impulse buying, giving a short-term boost to consumption and auto sales.

On the positive side, the government has at least acknowledged structural challenges, though experts say these changes should have come 5–6 years earlier.

Stock in Focus: Ola Electric

The stock has seen a meteoric rise of nearly 70% in just 15 days, prompting SoftBank to partially book profits by selling 2.15% of its stake. SoftBank still holds around 15.7%, reflecting confidence in Ola’s long-term potential.

Other Developments

- Bluestone Jewellery & Lifestyle: Reported Q1 loss of ₹35 crore (vs ₹60 crore loss YoY), with revenue rising to ₹492 crore from ₹348 crore. Margins improved to 11.3% from 0.6%, though analysts caution about intense competition in the jewellery retail space.

- TVS Motors: Launched the NTC 150 scooter; stock remained flat amid profit-booking from higher levels.

- Semiconductor Focus: PM Modi addressed Semicon India 2025, reaffirming India’s ambitions to become a global semiconductor hub. Companies like Tata and CESC Tech are already investing in chip manufacturing, making the sector one to watch.

Outlook

While GST changes have brought short-term sentiment boost, experts remain skeptical about their long-term economic impact. Insurance remains the most affected sector, while consumption-driven segments like autos could benefit temporarily.

Markets will remain open on Friday, with only a settlement holiday in effect — meaning trades will go through, but settlements will be processed later.