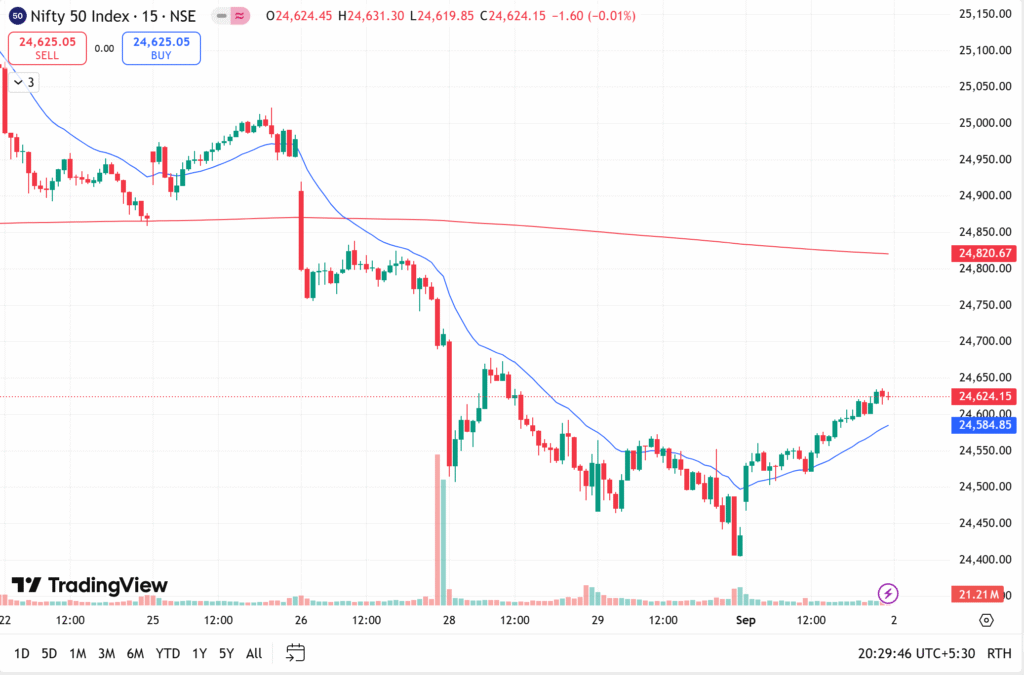

Market Closing Update: Nifty, Bank Nifty End Higher; Auto Sector Shines, EVs in Focus

Indian equity markets kicked off the month of September on a positive note. Both Nifty 50 and Bank Nifty closed near the day’s high levels, supported by strong buying interest across sectors, especially autos.

Key Market Highlights

- Bank Nifty jumped 346 points, closing above 54,000, supported by a bounce from the crucial 200-day exponential moving average.

- Nifty 50 gained 188 points, ending above 24,600.

- Market breadth was strong with more than 1,900 advancing stocks, nearly double the number of declining shares (~860).

- Global cues were mixed: Asian and European markets were largely positive, while Dow futures slipped slightly ahead of key US economic data.

Technical Picture

Analysts pointed out a morning star pattern forming on Bank Nifty charts, indicating a potential bullish reversal, though not a textbook setup. Immediate resistance is seen around 55,000 levels, suggesting limited upside of about 1,000 points in the near term. On the downside, 24,500–25,000 remains the key range for Nifty.

Sector & Stock Action

- Auto Sector Outperforms: Bajaj Auto surged 4%, Mahindra & Mahindra gained 3.5%, Tata Motors and Hero MotoCorp also rallied. Auto shares dominated the top gainers’ list.

- Lagging Stocks: Sun Pharma slipped 2%, while ITC, HUL, Titan and Reliance were under pressure. Reliance remained weak despite positive long-term brokerage targets.

- Mid & Small Caps:

- Gainers: SJVN Solar Electric (+15.5%), Kinetics Tech (+8%), GMDC, ABFRL among others.

- Losers: Waaree Energies (-6%), GF Phillip (-4%), PEL (-3%), UBL also fell.

One-Week Performance

- Winners: Ola Electric (+32%), Ratnamani India (+16.5%), ECLX and Granules (+8–9%).

- Laggards: Sundaram Finance (-15.5%), Angel One (-10%), RPower, Fiserv Life among others.

Auto Sales Data – August 2025

The latest monthly sales figures strengthened bullish sentiment in autos:

- Tata Motors: Commercial vehicles +10% YoY, passenger vehicles -3% YoY; overall sales 73,178 units, ahead of expectations.

- Mahindra & Mahindra: Total sales +1% YoY; SUVs -9% YoY, but stock closed higher on optimism.

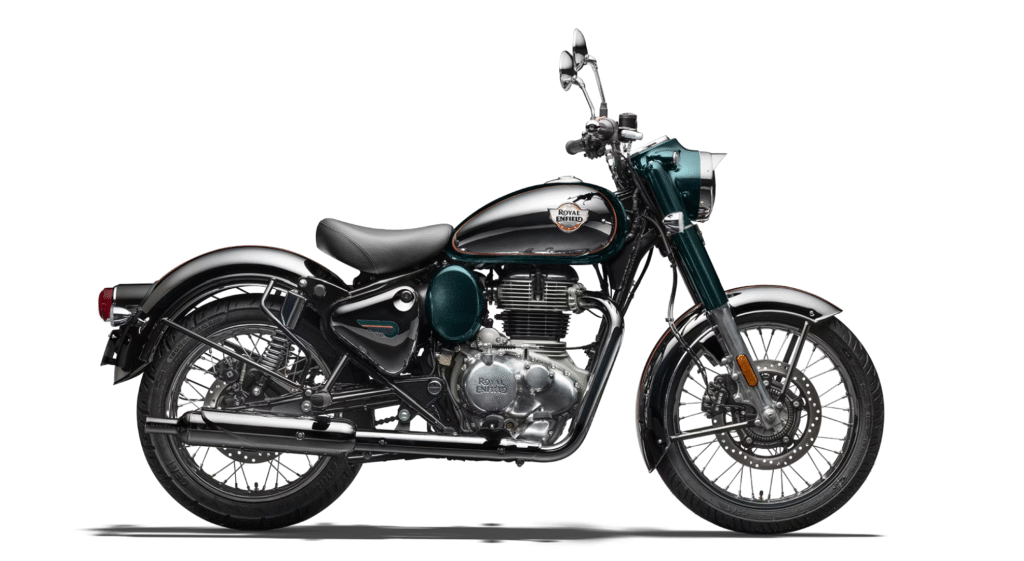

- Eicher Motors (Royal Enfield): Total sales +55% YoY, domestic sales +57%, exports +39%. Royal Enfield 350cc demand jumped 61% YoY.

- TVS Motors: Total sales +30% YoY, two-wheelers +30%, exports +35%, EV sales +145%. Stock hit new lifetime highs.

EV Market Share Shift

August data shows clear winners and losers among two-wheeler EV players:

- TVS Motors continues to outperform with steady share gains.

- Ather Energy climbed into the top three, expanding share consistently for four months.

- Hero MotoCorp also gained strong traction.

- Bajaj Auto lost significant market share, slipping out of the top three.

Policy & Macro Developments

- Reports suggest GST on air conditioners, TVs, and cement could be reduced from 28% to 18%, a positive for consumers.

- However, carbonated soft drinks may face a higher GST rate of 40%, potentially impacting companies like Varun Beverages.

- The Supreme Court dismissed a plea against ethanol-blended fuel, clearing the way for continued government push in this segment – a positive for sugar and ethanol players.

- Global developments also remained in focus, with US jobs data expected this week. A weak reading could trigger rate-cut hopes, weighing on the dollar but supporting gold and silver.

Outlook

With strong auto sales, robust market breadth, and improving macro cues, analysts expect the positive momentum to extend, though upside may remain capped near 55,000 (Bank Nifty) and 25,000 (Nifty 50). Broader market action and global triggers, especially US data, will guide sentiment in the coming sessions