Market Opening Today: Gift Nifty Positive, US Fed Rate Cut Expectations Lift Global Sentiment

The final trading session of the week has begun on a positive note with Gift Nifty indicating a strong opening of 67 points at 25,180 levels. This is nearly 150 points higher compared to Nifty 50’s Thursday closing above the 25,000 mark.

Asian markets are also trading firm with Nikkei up 229 points and Hang Seng gaining 460 points. The rally follows overnight strength in US markets, where expectations of a rate cut by the US Federal Reserve boosted investor sentiment. Analysts believe that with inflation cooling and economic growth slowing, the probability of a rate cut in the upcoming Fed meeting has increased.

Market Performance Recap

On Thursday, Nifty 50 closed 32 points higher, sustaining above the 25,000 milestone, while Bank Nifty added 320 points, ending at 54,670. The key levels to watch for Friday are:

- Bank Nifty resistance at 55,000

- Support at 54,200

- Nifty 50 sustaining above 25,000 remains crucial

Despite bouts of mid-day profit booking, markets have largely maintained a positive trend this week, in line with earlier projections that volatility would remain subdued. Notably, the India VIX has dropped to a 17-month low at 10.36, indicating extreme calm in the market.

FII-DII Activity

- Foreign Institutional Investors (FIIs) continued to sell, offloading shares worth ₹3,472 crore.

- Domestic Institutional Investors (DIIs), however, supported the market with net buying of ₹4,045 crore.

The Put-Call ratio improved slightly to 1.17 from 1.15, suggesting continued bullish sentiment.

Top Movers

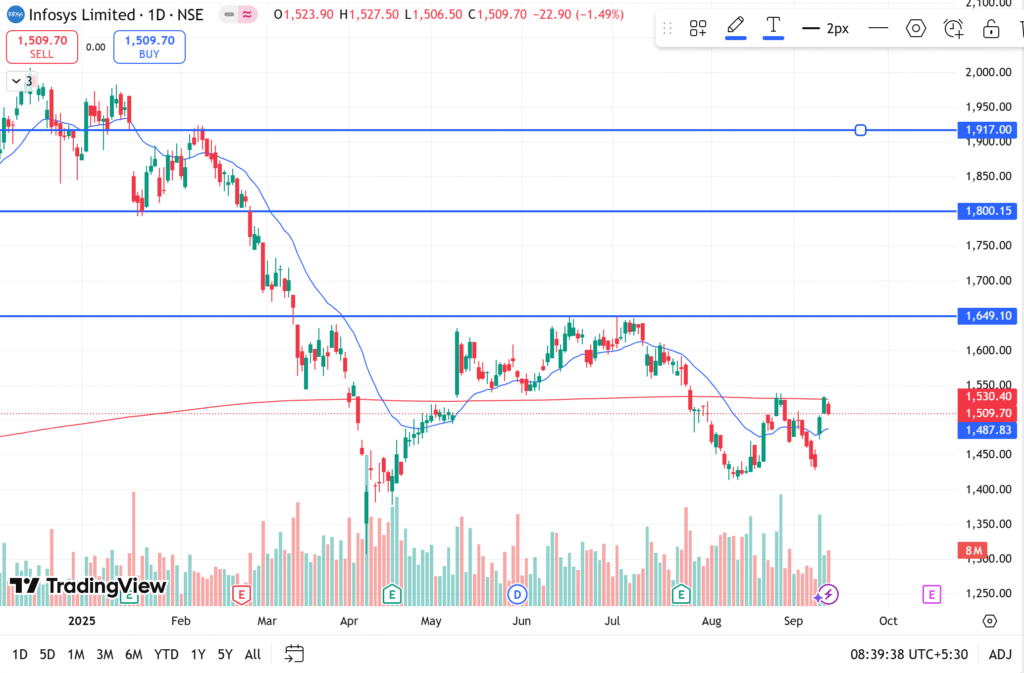

Among the gainers on Thursday were Shriram Finance (+2.5%), NTPC, and Axis Bank, all part of the F&O segment. On the losing side, Infosys slipped 0.5%, along with Bajaj Auto, Ashok Leyland, and SBI Life.

Infosys, however, is expected to see renewed momentum today as the company announced a ₹18,000 crore buyback at ₹1,800 per share, nearly 19% above current market price. The buyback plan, although debated among analysts, is seen as a shareholder-friendly move.

Commodities & Currency Watch

- Silver surged to ₹1.27 lakh per kg, and analysts expect the next major milestone could be ₹1.5 lakh.

- Gold witnessed mild profit booking but remains steady overall.

- The Indian rupee weakened further to 88.5 against the US dollar, extending its decline against global currencies.

IPO Buzz

The primary market continues to remain active:

- Urban Company IPO subscribed 6.37 times.

- Dev Accelerator IPO subscribed 11.86 times.

- Shringar House (jewellery brand) subscribed 5.23 times.

Market observers expect strong listing gains for all three issues.

Key Corporate Updates

- Canara Bank’s AMC arm (Canara RBC AMC) has received SEBI approval for IPO launch.

- NBCC signed a ₹3,700 crore MoU for development of Rajasthan Mandap, following the success of Bharat Mandap in Delhi.

- RailTel bagged ₹101 crore orders in Panvel and Nashik Smart City projects.

- Prostamps secured ₹149 crore order from Maharashtra’s DGP for IT infrastructure upgrades.

- Motilal Oswal Mutual Fund increased stake in HCG, while HDFC MF sold 1.9% stake in Bajel, taking total divestment above 3.5%.

Stocks to Watch Today

- NBCC (benefits from new project pipeline)

- Capital market players like BSE & Angel One (ahead of SEBI’s board meeting)

- Infosys and IT sector peers (on buyback news)

- Canara Bank (AMC IPO approval)

📌 Outlook: With global cues positive, FIIs still selling but DIIs providing strong support, and volatility at multi-year lows, the key question for today is whether Nifty can hold above 25,000 into the weekend close.