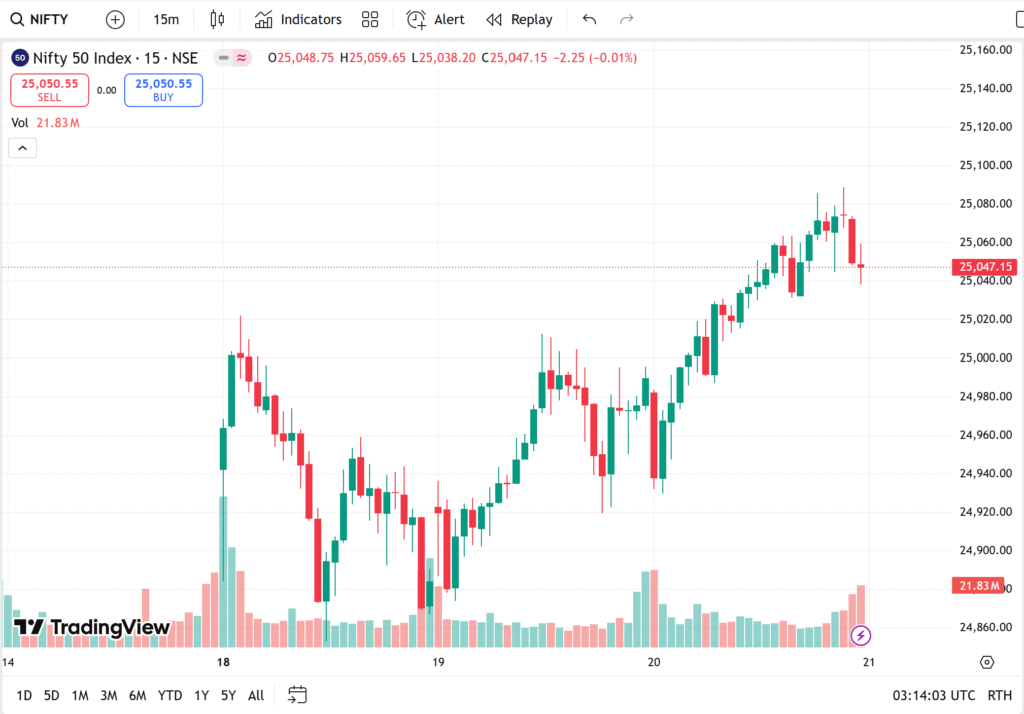

Stock Market Today: Nifty Holds Above 25,000; Bank Nifty Lags, IT & FMCG Shine – August 21, 2025

Thursday, August 21, 2025 – Gift Nifty is trading slightly positive, up by just 5 points, despite Nifty 50 closing above the crucial 25,000 mark yesterday. The cautious tone comes as Asian markets trade weak, with the Japanese market under pressure.

Yesterday, Bank Nifty failed to support Nifty’s rally, slipping 166 points, and could not break the 56,000 level. Currently, the upside momentum in Indian equities is being driven largely by Nifty 50 alone, while banking stocks remain subdued.

Why the Market Is Lacking Fresh Triggers

Most of the positive news flows are already priced in – from GST reductions to government incentives. While these measures supported Nifty’s rally past 25,000, analysts believe fresh triggers are required for further upside.

The concern for banks is that if the overall economy slows down, rising bad assets (NPAs) could weigh on both banks and NBFCs. This explains why Bank Nifty has not participated meaningfully in the rally.

Sector and Stock Performance

- IT & FMCG were the strongest performers yesterday.

- Infosys surged 4%

- TCS also gained sharply

- HUL closed 2.5% higher

- Top losers included:

- Biocon down 2%

- Bajaj Finance down 0.5%

- Tata Motors slipped 1.5%

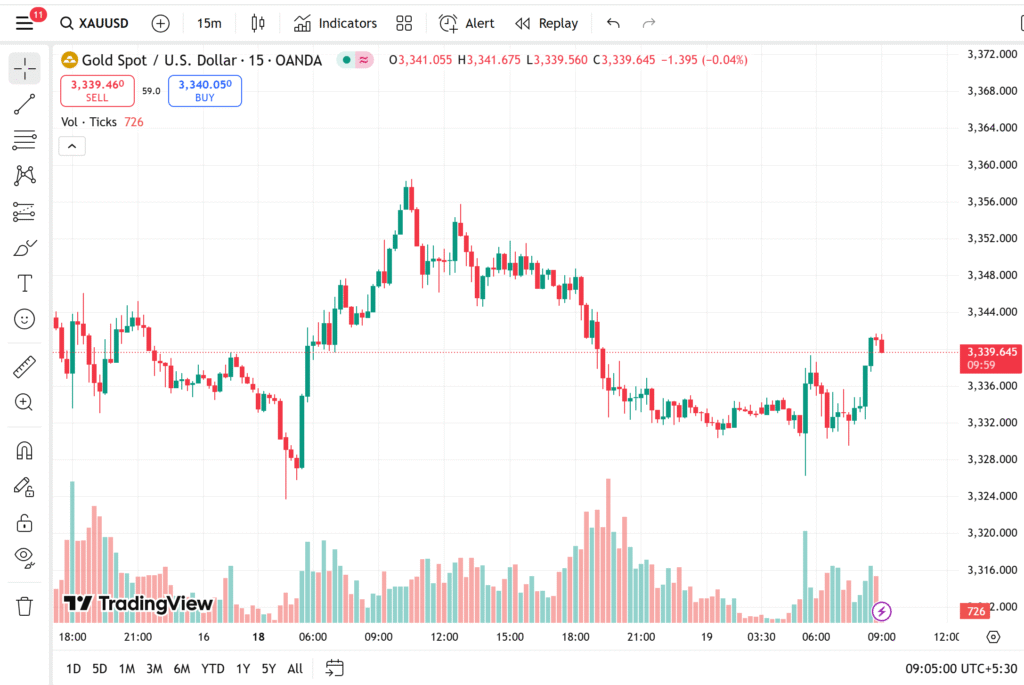

Commodities Update

- Gold fell below ₹1,00,000 per 10 grams.

- Silver is trading at ₹1,12,641 per kg.

- Both metals have been struggling for upward momentum over the past 6 weeks as valuations look stretched.

Currency Market

The Indian Rupee weakened against the US Dollar and Euro, though it was slightly stronger against the British Pound. After the initial post-GST cut rally, the rupee has once again started showing signs of weakness.

Key Nifty and Bank Nifty Levels

- Nifty 50 closed at 25,051, up 70 points.

- Resistance: 25,250

- Support: 24,800

- Bank Nifty is still struggling for a breakout above 56,000.

- Key supports: 55,550 – 55,400

FII/DII Data & Volatility

- FIIs sold stocks worth ₹1,100 crore

- DIIs bought stocks worth ₹1,800 crore

- India VIX remained steady at 11.78

Corporate & Fund Action

- Axis Mutual Fund acquired 13.92 lakh shares of Healthcare Global at ₹63 from promoters.

- ICICI Prudential Mutual Fund bought 41.51 lakh shares from promoters.

- Shanthi Gold reported a 174% jump in profit and 22.1% growth in revenue.

- CAMS subsidiary received RBI’s NOC for its Payment Aggregator business.

- SMC Global invested ₹15 crore in NCDEX, opening up a new exchange opportunity beyond NSE and BSE.

Major Orders & Contracts

- Hindustan Aeronautics (HAL) received a massive order worth ₹62,000 crore for 97 Tejas aircraft.

- HAL also announced a 550-bed super specialty hospital project near Gomti Nagar, Lucknow.

- Jupiter Wagons secured a ₹215 crore order for Vande Bharat train wheelbases.

- RITES Ltd. targets expanding its order book from ₹8,000 crore to ₹10,000 crore by FY-end.

IPO Watch

- Mangal Electricals IPO: 0.5x subscribed (Day 1).

- Shreeji Shipping IPO: 6.5x subscribed (Day 2).

- Patel Retail IPO: 19.5x subscribed (Day 2).

- Vikram Solar IPO: 4.5x subscribed (Day 2).

- Gem Aromatics IPO: 2.9x subscribed.

Key Negative News

- Clean Science promoters plan to sell 24% stake worth ₹2,626 crore.

- India Cements will offload 6.49% stake (2.01 crore shares) via OFS on August 21 (non-retail) and August 22 (retail).

Stock Ban Update

- PGL (PG Electroplast) has re-entered the F&O ban list after just 2 days out.

✅ Summary: Nifty 50 is holding strong above 25,000, but Bank Nifty’s weakness remains a concern. IT and FMCG are driving gains, while metals, rupee, and select NBFCs remain under pressure. IPO activity remains strong with heavy subscriptions in multiple issues.