Market Update: Nifty Crosses 25,000, Gold Shines, and IT Sector Gains Ahead of Infosys Buyback

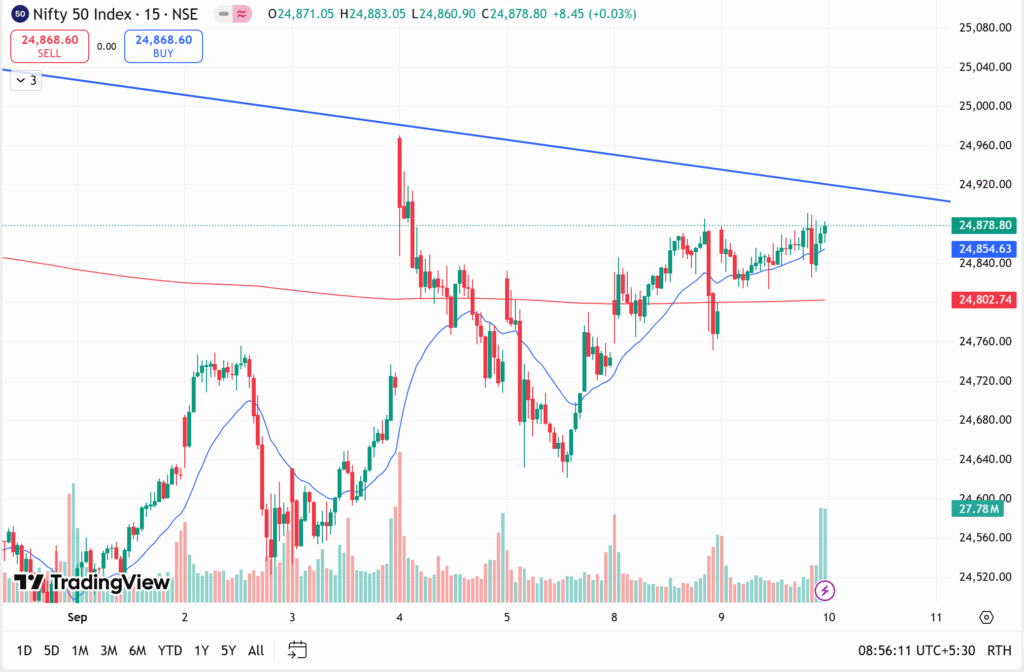

Indian markets opened the day on a positive note in line with global cues. As expected in this week’s outlook, the Nifty 50 is gradually moving higher and has already touched the key 25,000 level. At present, Gift Nifty is trading about 45 points higher, reflecting investor optimism.

Global Market Trends

Asian markets are trading strong, with Nikkei up 135 points and Hang Seng gaining 243 points. Analysts note that the direct impact of U.S. markets on India is reducing over time, as the Indian economy becomes less dependent on U.S. trade and IT sector links.

Domestic Indices

On Tuesday, the Nifty 50 closed above 24,800, which is a positive technical sign. The next major resistance is at 25,000, which has already been tested in today’s session. Meanwhile, Bank Nifty closed 29 points higher at 25,216, although the session remained largely range-bound.

The important support for Bank Nifty stands at 54,000, and sustaining above current levels could trigger short covering, though analysts caution that extremely low volatility limits sharp upside moves.

Sector & Stock Action

The IT sector was among the top gainers yesterday, led by Infosys after reports that the company will consider a share buyback in its September 11 board meeting. This news triggered buying interest across the IT pack, even though broader fundamentals remain stable.

Among other movers, Dr. Reddy’s was a top gainer, while Trent, Jio Financial, NTPC, and Eternal featured among the top losers in the F&O segment.

Results from Vikram Solar were better than expected, with strong growth in profit, revenue, and margins compared to last year.

Gold & Silver

Gold continues its strong momentum. Prices, which were near ₹1,00,000 at the last update, have now surged to around ₹1,12,680.00 Indian Rupee, showing over 10% gains in just 10 days. Silver is trading near ₹1,25,000. Analysts say charts show no signs of weakness in gold, but advise investors to do their own research before making fresh entries.

Currency & FII/DII Activity

The Indian rupee remains weak overall but showed mild strength against the U.S. dollar yesterday. Against the euro, pound, and yen, weakness persists.

Foreign Institutional Investors (FIIs) bought shares worth ₹2,050 crore, while Domestic Institutional Investors (DIIs) added ₹83 crore, taking the combined inflow to over ₹2,100 crore.

Volatility Index (VIX)

India VIX dropped further to 10.68, indicating very low volatility. While this creates favorable conditions for option writing, experts warn that any sudden negative news could trigger a sharp spike in premiums, potentially trapping traders.

Corporate Updates

- Bajaj Auto announced it will pass on GST benefits to customers, with discounts up to ₹20,000 on two-wheelers and ₹24,000 on three-wheelers.

- M&M’s production rose 9% in August, signaling strong demand.

- Thermax announced a ₹115 crore capex plan in its energy subsidiary.

- Insurance companies are raising premiums, but experts caution against delaying insurance purchases.

- Kotak Mahindra Bank is expected to see a 1.65% stake sale today.

- Sun Pharma’s Halol plant received a U.S. FDA observation for non-compliance with certain manufacturing practices.

- Bikaji Foods has been summoned by the Enforcement Directorate (ED) in connection with a money-laundering case, though the company has denied any wrongdoing.

Technology & Global News

Apple launched the iPhone 17 yesterday, but its shares fell by 2% after the event. Market watchers suggest keeping an eye on Indian distributors like Redington, which could feel the impact.

Meanwhile, SEBI’s restrictions on stock recommendations across social media have led to a decline in active client numbers for brokerages in August, reflecting reduced retail participation.

✅ Key Stocks to Watch: Kotak Mahindra Bank, BlueJet, Sun Pharma, Bikaji Foods, RBL Bank.

✅ Levels to Track: Nifty 25,000 (resistance), Bank Nifty 54,000 (support).

✅ Global Trigger: Asian markets positive; U.S. cues less relevant for Indian trend.