📰 Market Closing Update: August 29, 2025

Nifty Ends Below 24,500 | Reliance AGM Highlights Jio IPO in 2026

On Friday, August 29, 2025, the last trading session of the week, Indian markets witnessed another volatile day. Bank Nifty successfully touched its 200-day exponential moving average (EMA) during the session and closed almost at its opening levels, signaling indecision.

The Nifty 50 closed at 24,426, down 74 points, below the crucial 24,500 mark, while Bank Nifty also ended near the day’s low. Market sentiment remained weak despite several positive triggers, largely because of prevailing global concerns and heavy FII outflows.

Reliance AGM: Jio IPO announcement

One of the key events today was Reliance Industries’ Annual General Meeting (AGM). The company announced that Jio’s IPO will be launched in the first half of 2026 (H1 2026).

While this should have been taken as a positive, the market reacted negatively. Investors were expecting a possible demerger and free allotment of Jio shares to existing Reliance shareholders. Instead, Reliance clarified that value unlocking will happen through the IPO route. As a result, Reliance shares closed 2% lower at day’s low, dragging Nifty down with it.

Interestingly, the Jio IPO news gave a positive push to Bharti Airtel, which gained as investors expect re-rating in telecom sector valuations once Jio lists at higher multiples.

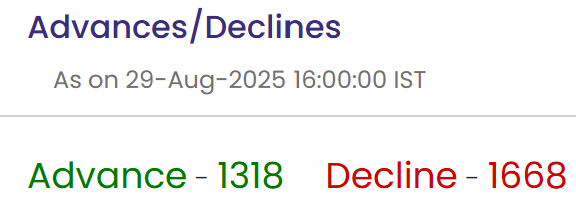

Market Breadth & FII-DII Data

- Declining stocks: 1668

- Advancing stocks: 1,318

- FIIs sold shares worth ₹8,100 crore

- DIIs bought shares worth ₹11,000 crore, supported by strong SIP inflows

The advance-decline ratio fluctuated throughout the day but eventually closed weak.

Global & Macro Factors

Globally, sentiment remains under pressure with recessionary fears and ongoing US tariff issues. However, India is relatively insulated as exports to the US form only 8% of total exports.

On the positive side, India’s GDP growth came in at 7.8%, compared to 6.5% last year – the highest in five quarters. Agriculture grew 3.7% (vs. 1.5% last year), while services reported a strong 9.3% growth. The biggest support continues to be from cheap Russian crude oil imports, which is helping India manage inflation and energy costs.

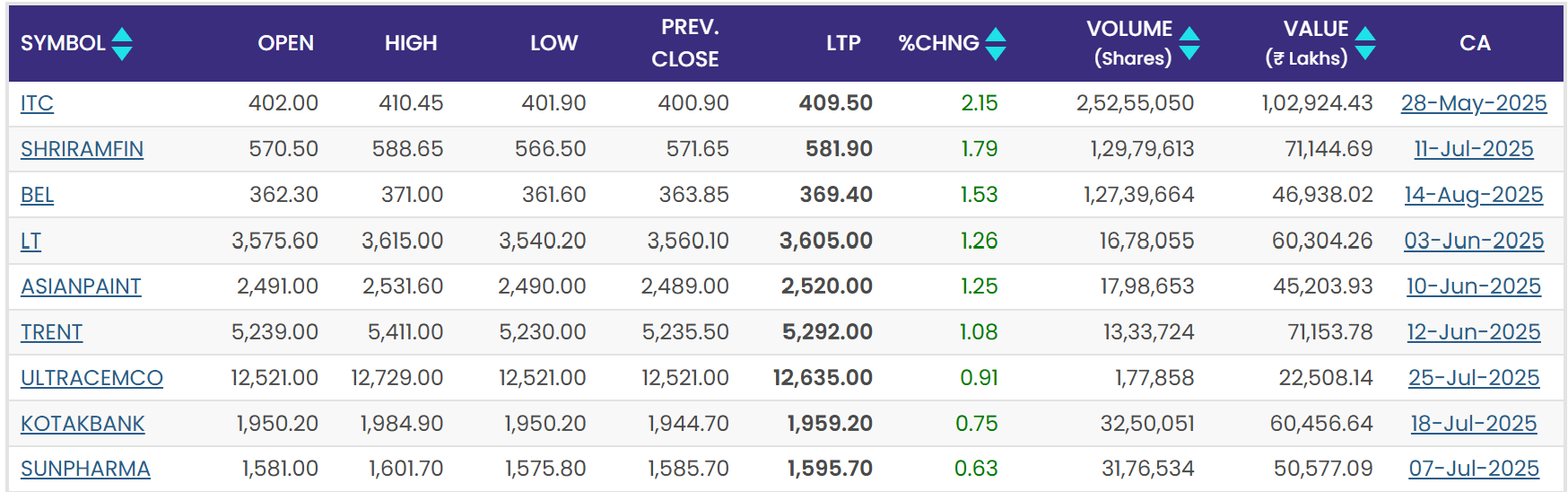

Sector & Stock Highlights

Top Nifty 50 Gainers:

- ITC (+2%)

- Trent, Asian Paints, and other select FMCG & retail stocks

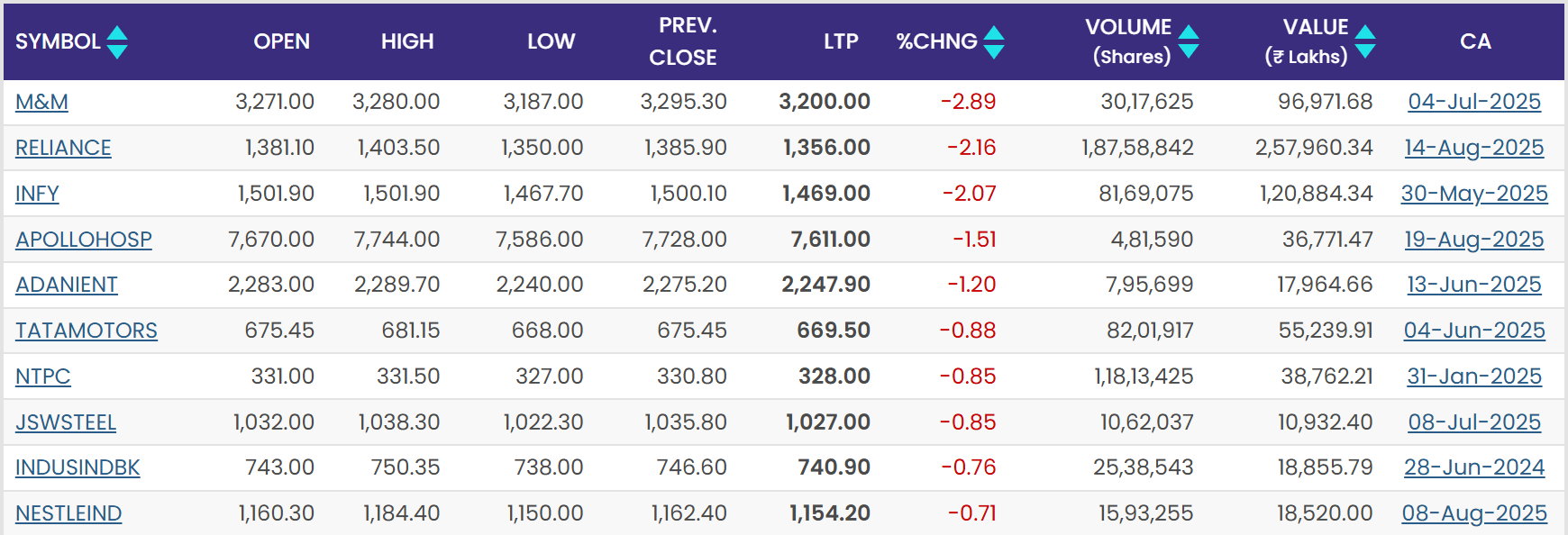

Top Nifty 50 Losers:

- Reliance (-2%)

- Infosys

- Apollo Hospitals

- Adani Enterprises

- M&M

Top Gainers (Broad Market):

- Saman Capital (+5%) after successful fundraise

- CG Power, NV, and others

Top Losers (Broad Market):

- VTL (-5.5%)

- JSL (-5.5%)

- IDBI, BSE, and select energy names fell sharply

One-week performance:

- Outperformers: Rattan India (+14.5%), Ola Electric, Netweb, Granules India

- Underperformers: Sundaram Finance (-14%), Engine One (-13%), RPDBI Life

Banking & IT Pressure

Banking stocks saw weakness, with HDFC Bank sliding nearly 6% from lifetime highs. IT stocks also remained under selling pressure amid weak global cues.

Sector in Focus: Defence & Consumption

Defence stocks remained strong with companies like Apollo Micro Systems gaining 8.5% after signing a new technology transfer agreement with DRDO. Analysts expect private defence players such as Zen Technologies, Data Patterns, and Astra Microwave to benefit from upcoming orders.

On the consumption side, despite near-term worries, India’s domestic demand story remains intact, supported by GST reduction in certain categories.

Outlook

Markets are approaching the crucial 24,200 support level on Nifty (200-day EMA). A decisive break below this level could trigger a sharp downside of up to 700 points.

At the same time, experts believe that periods of negative sentiment often offer opportunities to accumulate high-quality companies at attractive valuations.

Investors are advised to stay cautious, avoid panic, and focus on fundamentally strong businesses for long-term gains.