Stock Market Today: August 26, 2025 – Nifty Below 25,000, Global Cues Weak

Indian markets opened weak today, tracking negative global cues. The Gift Nifty slipped 73 points and is currently trading near 24,920 levels, while Nifty 50 had closed at 24,967 yesterday. This indicates a mild downside of around 40 points.

🌏 Global Market Pressure

- Asian markets are trading sharply lower – Nikkei down nearly 450 points.

- US markets remain under pressure.

- Adding to concerns, the US has imposed an additional 25% tariff on Indian imports, effective from January 27, 2026.

📉 Nifty and Bank Nifty Key Levels

- Nifty’s immediate support lies at 24,800 and resistance at 25,000.

- Bank Nifty failed to break above the 55,000 mark yesterday and closed flat. Traders will watch closely if 55,000 is breached today.

📊 Sector Performance

- IT stocks were the top gainers yesterday – Infosys rose 3%, TCS up nearly 2.5–3%, HCL Tech and Wipro also advanced.

- However, profit booking may drag these stocks today.

- On the downside, Adani Enterprises, Apollo Hospitals, BHEL and CESC closed with mild losses (up to 1%).

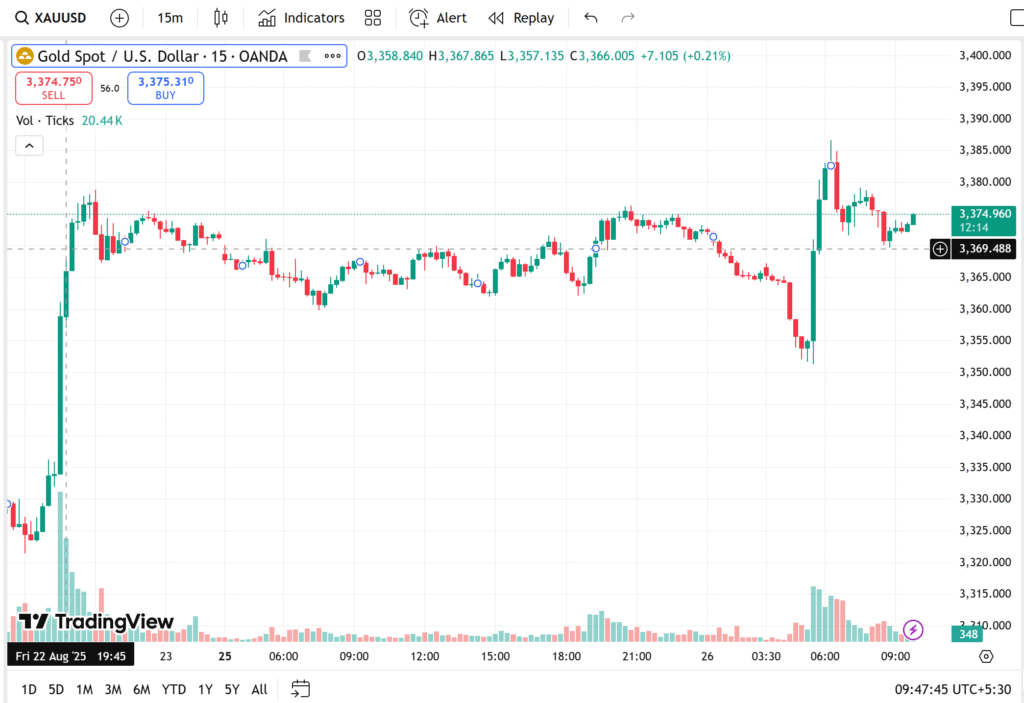

💰 Commodities

- Gold prices surged above ₹1,00,000 per 10 grams, while Silver is trading at around ₹15,000.

- Analysts, however, believe valuations remain unattractive at such elevated levels.

💱 Currency Market

- The Indian Rupee weakened against the US Dollar and British Pound.

- It showed mild strength against the Euro and Japanese Yen.

📈 FII & DII Activity

- Foreign Institutional Investors (FIIs) sold equities worth ₹2,466 crore yesterday.

- Domestic Institutional Investors (DIIs), on the other hand, bought shares worth ₹329 crore.

⚡ Volatility Update

- The India VIX (Volatility Index) inched higher.

- Put-Call Ratio (PCR) stayed around 1, suggesting the market is trying to remain range-bound with limited scope for short-covering rallies.

🏢 Corporate Updates

- Protein E bagged a government order worth ₹1,160 crore to establish UIDAI Aadhaar centers across districts.

- Lemon Tree Hotels signed a new lease agreement in Nashik; operations to be managed by subsidiary Carnation Hotels.

- Suraj Estate Developers purchased a 644 sq. meter land parcel in Mumbai, expected to generate ₹130 crore revenue potential upon development.

🛳 IPO and Listings

- Today’s IPO listings include Vikram Solar, Patel Retail, Gym Aromatics, and Shreeji Shipping.

- Market experts expect Shreeji Shipping to deliver the strongest listing gains.

🔎 Other Key Developments

- Mazagon Dock’s ₹70,000 crore deal with Germany’s ThyssenKrupp was canceled – a setback for the defense shipbuilder.

- LIC sold 0.58% stake in TNPL, reducing its holding from 1.8%.

- Government is expected to accelerate disinvestment in PSU banks including UCO Bank, Central Bank, IOB, and others.

- RBL Bank and PG Electroplast exited the F&O ban list.

📌 Bottom Line:

The near-term trend for Indian equities remains cautious with global weakness, higher volatility, and fresh US tariffs adding pressure. Nifty 50 faces a tight range between 24,800 support and 25,000 resistance. Traders should keep an eye on IT, Pharma, export-oriented companies, and PSU banks amid rising government divestment activity.