Stock Market Today: Nifty 50 Holds Range; IT Stocks Shine on Infosys Buyback Buzz, Mid & Smallcaps Lead

Indian markets remained largely range-bound on Tuesday with benchmark indices showing little volatility for the eighth consecutive session. Traders noted that intraday moves were restricted to the final hour, leaving option buyers with very limited opportunities.

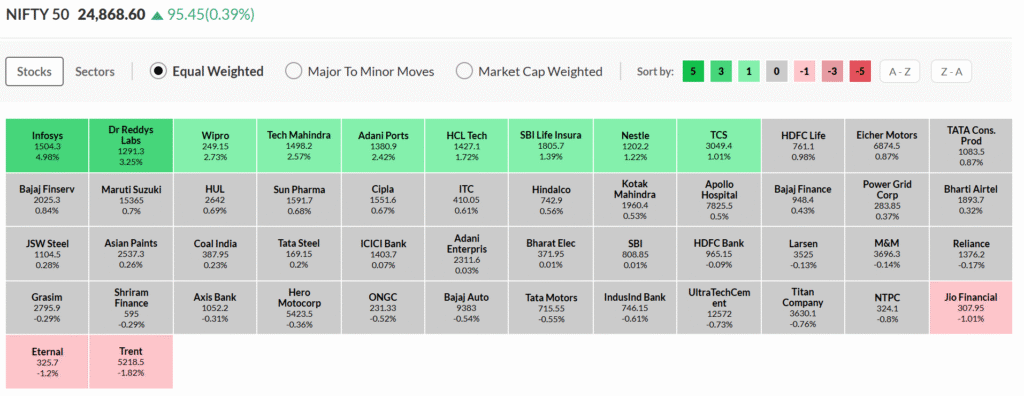

The Nifty 50 closed just above the 24,800 mark, attempting to sustain above this crucial level, while Bank Nifty remained flat around 54,000, moving less than 0.05% throughout the day. In contrast, midcap and smallcap indices outperformed, with the Nifty Midcap index gaining over 100 points.

Advance-Decline Ratio Balanced

The advance-decline ratio was evenly poised as the day progressed, with nearly 950 stocks advancing and an equal number declining. Analysts noted this confluence as a sign of consolidation across sectors.

Global Cues

- GIFT Nifty traded flat at 24,953, slightly higher than the domestic close.

- Dow Jones Futures were up 72 points.

- European markets showed mixed trends.

Importantly, there was no sharp negative trigger from the global front, which helped Indian equities remain steady.

Sector & Stock Highlights

- IT stocks led the rally, with Infosys gaining nearly 5% after the company announced that its board will consider a share buyback on September 11. Investors await clarity on the buyback size, pricing, and mode (tender route or open market). Wipro, Tech Mahindra and HCL Tech also ended higher.

- Top gainers included Infosys, Tech Mahindra, Wipro, and Adani Ports.

- Top losers were Trent (-2%), NTPC, Titan, and Paytm, where profit booking dragged prices lower.

- In the mid & smallcap space, Floro Chemicals led the gains, followed by Intellect Design and Real Estate names. On the flip side, GMDC slipped 3%, while Balrampur Chini and India Cements were among the notable losers.

Over the past week, Netweb Technologies surged 40%, GMDC jumped 21%, while Honeywell Automation and CreditAccess Grameen fell over 7% each.

IT Sector Accumulation

Despite global concerns around H1-B visa restrictions in the US, analysts believe the Indian IT sector remains resilient due to its skilled talent pool and cost arbitrage advantage. Long-term prospects remain intact, though the industry has been criticized for limited innovation in proprietary platforms.

Block Deals & Corporate Updates

- Kotak Mahindra Bank: Japan’s SMBC is expected to offload a 1.65% stake via a block deal worth ₹6,166 crore at a floor price of ₹1,880 per share. While the stock closed at ₹1,960 today, analysts expect strong demand to absorb the deal.

- Blue Jet Healthcare: Promoter Akshay Arora will sell a 3.42% stake at ₹675 per share, compared to today’s closing of ₹730. This could trigger a sharp decline in the stock tomorrow.

- Sterling & Wilson Solar: Secured a ₹415 crore EPC order for a 300 MW solar project, the company’s largest order this fiscal year.

- Vikram Solar: Won a 336 MW order from L&T; results are expected later today.

- Waaree Renewables: Bagged a ₹1,252 crore order, with the stock gaining 3%.

iPhone 17 Launch Buzz

Apple’s global launch of the iPhone 17 is set to impact Indian distributors. Redington, Apple’s largest distributor in India, has consolidated around the ₹240–₹250 zone after falling from July highs of ₹330. Analysts say the success of iPhone 17 could determine Redington’s next leg of performance. Dixon Technologies, which manufactures LED screens for iPhones in India, has already given a breakout on charts and is seen as a key beneficiary.

Insurance Sector Under Pressure

Insurance companies continue to face weakness as policy renewals are being deferred until the GST cut on premiums comes into effect from September 22. Premium collections have dropped for the third consecutive month, but analysts view this as temporary.

Outlook

Analysts expect the market to remain in a tight range until volatility (India VIX) rises above 12. With VIX below 10, sharp directional moves are unlikely, making option writing strategies more favorable than option buying.

That said, stock-specific opportunities remain strong in IT, renewables, and solar energy companies. Long-term investors are advised to maintain focus on growth sectors and avoid chasing short-term volatility.