Stock Market Today: Nifty, Bank Nifty End Lower Amid GST Council Buzz, Trump’s Surprise Remarks, EV GST Hike and Sugar Stocks Rally

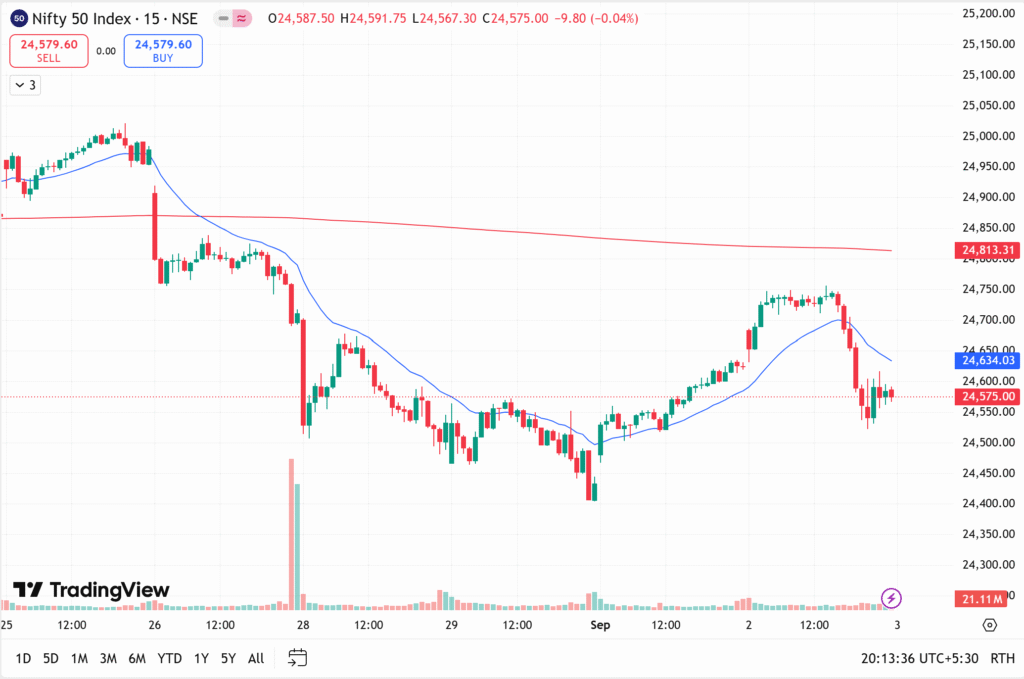

Indian equity markets closed on a weak note despite a strong intraday rally. The Nifty 50, which was up nearly 150 points in early trade, eventually slipped to close around 50 points lower. Bank Nifty faced heavier selling pressure, ending the day nearly 350 points down.

Markets witnessed sharp profit booking after 2:30 PM, triggered by negative news flows on the GST Council meeting and expectations of a sudden announcement from former US President Donald Trump.

Intraday Volatility and Profit Booking

- Nifty 50 tested resistance near 24,800 but failed to sustain.

- Bank Nifty saw a steep fall of nearly 500 points within one hour, sliding from 54,100 to 53,600.

- Advance-decline ratio remained positive until noon but reversed sharply post-GST related news.

- FIIs sold equities worth ₹1,159 crore, while DIIs supported the market with ₹2,500 crore of fresh buying.

Traders locked in profits early, with heavy unwinding seen in put writing positions. Many market participants preferred to secure capital rather than risk volatility ahead of key events.

Key Factors Driving the Market

1. GST Council Meeting

The GST Council meeting scheduled for September 3–5 created jitters in the market. Speculation around tax changes, particularly for electric vehicles (EVs) and drones, weighed on sentiment.

- EV GST Rate Hike: The panel recommended raising GST on EVs priced between ₹20–40 lakh from 5% to 18%. This could impact premium EV manufacturers like Mahindra & Mahindra, Tata Motors, and global EV brands in India.

- Drone GST Cut: GST on drones is proposed to be reduced from 18% to 5%, boosting companies aligned with government’s digital and defense-tech initiatives.

2. Trump’s Surprise Announcement

Global markets turned cautious as Donald Trump hinted at a sudden defense-related announcement. Dow Jones futures slipped nearly 600 points, while Nasdaq fell 1.5% and S&P 500 also traded lower. This “fear of the unknown” weighed on Indian equities.

3. Ethanol Policy Boosts Sugar Stocks

The Supreme Court dismissed a plea against ethanol production, paving the way for the government’s order allowing unrestricted ethanol production from sugarcane juice, syrups, and molasses.

- Sugar stocks like Renuka Sugar, Dwarikesh, and other mid-cap players surged.

- CIN Agro nearly doubled from ₹400 to ₹800 within a month, riding on ethanol optimism.

4. Sector Performance

- Top Gainers: Power Grid (+2.5%), Tata Consumer (+2.5%), NTPC, and Tata Steel supported Nifty.

- Top Losers: M&M, Kotak Mahindra Bank, ICICI Bank, and Asian Paints dragged indices lower.

- Auto Sector Pressure: Stocks like Hero MotoCorp, Bajaj Auto, and Maruti witnessed profit booking amid the EV GST hike proposal.

5. Stock-Specific Updates

- Quadrant Future Tech: Won a ₹129 crore contract for the Kavach anti-collision rail system from IRCON (East & Central Railways). Execution timeline: 24 months.

- Denta Water: Secured a ₹33 crore order for sewage system construction and upgradation in Kungal town, adding to its strong project pipeline worth ₹748 crore.

Weekly Performance Snapshot

- Top Performers (1 week): Ola Electric (+28%), RattanIndia, Renuka Granules, and other EV-aligned/sugar companies.

- Top Underperformers (1 week): Sun Finance (–13%), Shriram Finance, Sun Pharma, M&M, HDFC Bank, Reliance Industries.

Outlook

The market closing near day’s lows signals nervousness ahead of the GST Council meeting and global uncertainty from Trump’s remarks. Analysts expect volatility to continue with 24,800 as a key resistance for Nifty 50 and 53,600 as critical support for Bank Nifty.

Investors should keep a close watch on:

- GST announcements on EVs, ethanol, drones

- FII–DII flow trend

- Global cues from the US markets