Markets Today: Positive Global Cues, Auto Stocks Shine, Gold & Silver Rally

Indian equity markets are set to open on a positive note today, supported by strong global cues and sector-specific developments. Gift Nifty is trading 36 points higher, while Asian markets also remain upbeat — Nikkei is up nearly 140 points and HSI is in the green. Although the Dow Jones is flat, it is not showing any major weakness either, adding to overall optimism.

Market Recap: September 8

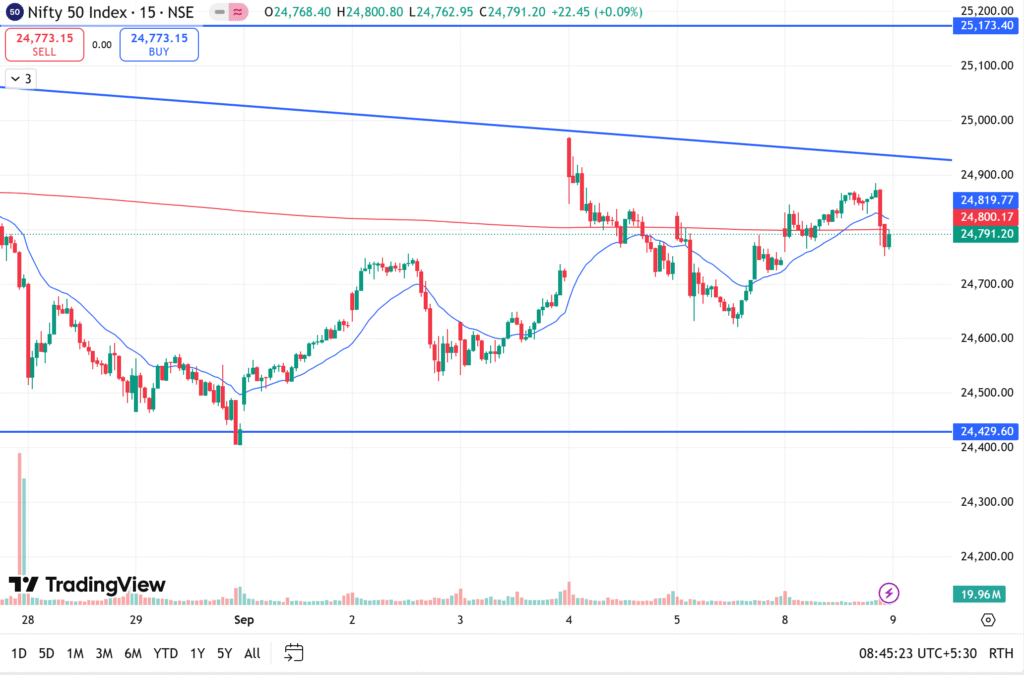

On Monday, both Nifty 50 and Bank Nifty traded in positive territory for most of the session. However, a sharp correction in the last half hour erased part of the gains. Nifty corrected over 200 points intraday, while Bank Nifty fell nearly 350 points before recovering. Both indices still closed in positive territory, though at levels close to their opening.

Midcap and small-cap indices continue to outperform with strong buying interest and no signs of profit booking. Analysts note that as long as these broader indices remain strong, there is little reason for panic among investors.

Sectoral Moves

The auto sector led gains with Tata Motors, Mahindra & Mahindra, and Bajaj Auto each rising nearly 4%. On the flip side, key losers in the F&O segment included Trent (-4%), Asian Paints (-2%), and Nestle (-2%) after a strong rally in recent weeks. Coal India also declined 1.5%.

Commodities Update

- Gold surged to ₹1,11,110.00 Indian Rupee

per 10 grams, up nearly 9% in the past week. - Silver crossed ₹12,25,000 per kg, reflecting strong demand in commodities alongside equities.

Currency Concerns

The Indian rupee remains under pressure against major global currencies such as the euro, pound, and yen. Analysts suggest that only higher foreign inflows can stabilize the currency. Until then, the government is focusing on boosting domestic consumption to offset export challenges.

Technical Levels

- Nifty 50: Closed 32 points higher at 24,773. Resistance remains at 24,800, followed by 25,000.

- Bank Nifty: Gained 72 points, with strong resistance seen at 54,250.

FII activity continues to show selling pressure due to high U.S. interest rates, while DIIs bought equities worth ₹34 crore. Volatility Index (VIX) edged up to 10.84, indicating a stable outlook with no major volatility expected.

Key Corporate Updates

- Amrita Healthcare to list today.

- RailTel won ₹74 crore IT-related orders from Bihar Education Project Council.

- HUDCO to provide ₹11,300 crore funding to Nagpur Metro Region Development Authority over the next five years.

- IRB Infra reported a 12% rise in toll collections, sparking debate over the need for toll reforms.

- Brigade Enterprises announced a 10.75-acre project in Bengaluru, with a development value of ₹2,500 crore.

- TVS Motor confirmed it will pass on full GST benefits to its ICE (internal combustion engine) portfolio.

- Godrej Consumers to invest ₹250 crore in a new manufacturing site in Kerala.

- SBI Mutual Fund acquired 1.42% stake in Goodluck India.

- Crafts Emerging Market Fund bought a 3.87% stake in Prime Focus for ₹188 crore.

Global Factors

Apple is set to launch its iPhone 17 today, while the U.S. unemployment rate has reached a four-year high. This increases expectations that the Federal Reserve may cut interest rates in September, which could improve global liquidity and trigger higher inflows into Indian markets in the coming months.

Ban List

RBL Bank remains the only stock under the F&O ban.

Stocks to Watch

- Vikram Solar and Recall Resources are scheduled to announce results today.

- Air Infra and select IT and infra stocks remain on analysts’ watchlists.

- Resources

📌 Outlook: Market momentum remains supported by strong auto stocks, commodity rallies, and positive corporate news. While FIIs continue to sell, DIIs and retail participation are keeping indices stable. Traders should watch the 24,800–25,000 zone on Nifty and 54,250 on Bank Nifty for directional cues.