Stock Market Today, September 16: Nifty Starts Flat, US Delegation Visit in Focus

The Indian stock market opened on a cautious note this Tuesday. Gift Nifty was trading 23 points lower in early deals, indicating a soft start for domestic equities. Meanwhile, Asian markets showed positive momentum, while Dow Jones futures remained flat with a modest gain of just 10 points.

A key event to watch today will be the arrival of the US trade delegation in India for high-level negotiations. Market participants are expected to track developments closely as any updates could influence investor sentiment.

Market Recap: September 15

On Monday, the Nifty 50 closed 45 points lower but managed to hold above the 25,000 mark at 25,070. In contrast, Bank Nifty gained 79 points to settle at 54,887. Analysts noted that despite the mild decline, both indices continue to trade in a positive trajectory.

Nifty 50 is currently facing strong resistance at 25,200. Experts believe that consolidation around this level would strengthen market fundamentals. On the downside, 25,000 remains a critical support level. For Bank Nifty, resistance is seen at 55,000, with immediate support at 54,500.

F&O Highlights

In the derivatives segment, Jio Financial led the gainers with a nearly 0.5% rise. Bajaj Finance, Eternal, and UltraTech Cement were also among the top performers. On the losing side, Asian Paints slipped close to 2%, while SPL and M&M Financial ended weaker.

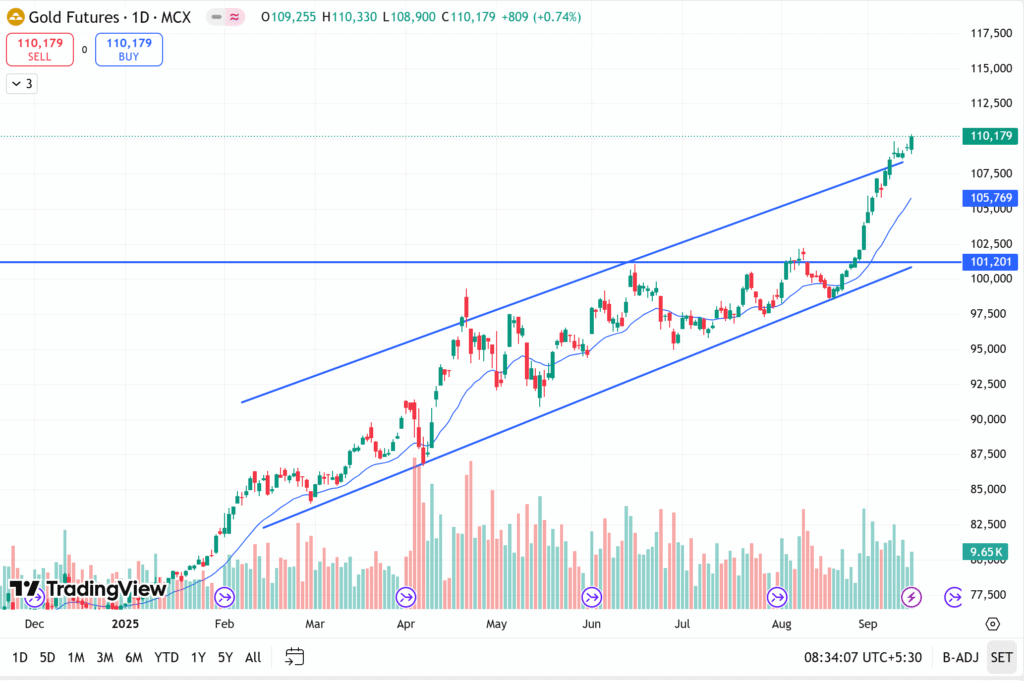

Global Commodities Update

Gold continued its rally, breaching the $1,100 mark in the international market, making domestic prices significantly higher. A 10-gram gold coin is now expected to cost nearly 8% more, around ₹1,20,000. Silver prices also surged to approximately ₹1,30,000.

Crude oil and natural gas registered gains as well, while the Indian rupee showed mild weakness against the US dollar and other major currencies including the euro, British pound, and Japanese yen.

FII & DII Data

Foreign institutional investors (FIIs) sold equities worth ₹1,268 crore on Monday, while domestic institutional investors (DIIs) were net buyers with purchases of ₹1,933 crore. The volatility index (VIX) remained subdued, providing favorable conditions for option writers rather than buyers.

Stock-Specific Developments

- Patel Retail reported a 13.2% rise in profit and a 2.86% increase in revenue. The company is also looking at aggressive expansion plans and fund requirements.

- Trans Rail secured new orders worth ₹421 crore, up 78% from last year. Related firms like HBL Engineering and Siemens may also benefit.

- Adani Enterprises announced a major ₹4,081 crore investment in a prestigious ropeway project from Sonprayag to Kedarnath.

- Miyani Industries bagged fresh orders worth ₹136 crore, taking its order book to ₹1,983 crore.

- Maruti Suzuki is set to launch its new model Victoris at an introductory price of ₹1.49 lakh, effective September 22, coinciding with the rollout of the new GST regime.

- Bajaj Finserv received a favorable ruling as the Bombay High Court quashed a ₹74 crore claim against Bajaj Allianz.

- Godawari Power saw promoter-level buying with Amrita Kedia acquiring 32.5 lakh shares worth ₹78.65 crore.

- Resourceful Auto witnessed bulk buying of 31,200 shares by Plutus Wealth Management at ₹62.85 per share.

- Lakshmi Dental saw a 2.03% stake sale by RDA, which was acquired by ICICI Prudential Mutual Fund for ₹48.5 crore.

Outlook

Experts suggest that as long as Nifty sustains between 25,000 and 25,200, market consolidation will build strength for the next move. With global cues, the US trade delegation visit, and stock-specific news in focus, volatility may increase in the coming sessions.