Stock Market Today — September 5, 2025: Nifty ends flat; autos & metals steady, IT lags; FIIs sell ₹1,305 cr

On the occasion of Teachers’ Day and the last trading session of the week, Indian equity markets ended largely unchanged in a muted, range-bound session. Volatility was evident during the day, but both the Nifty 50 and Nifty Bank closed flat, reflecting caution amid a settlement holiday.

Market Recap

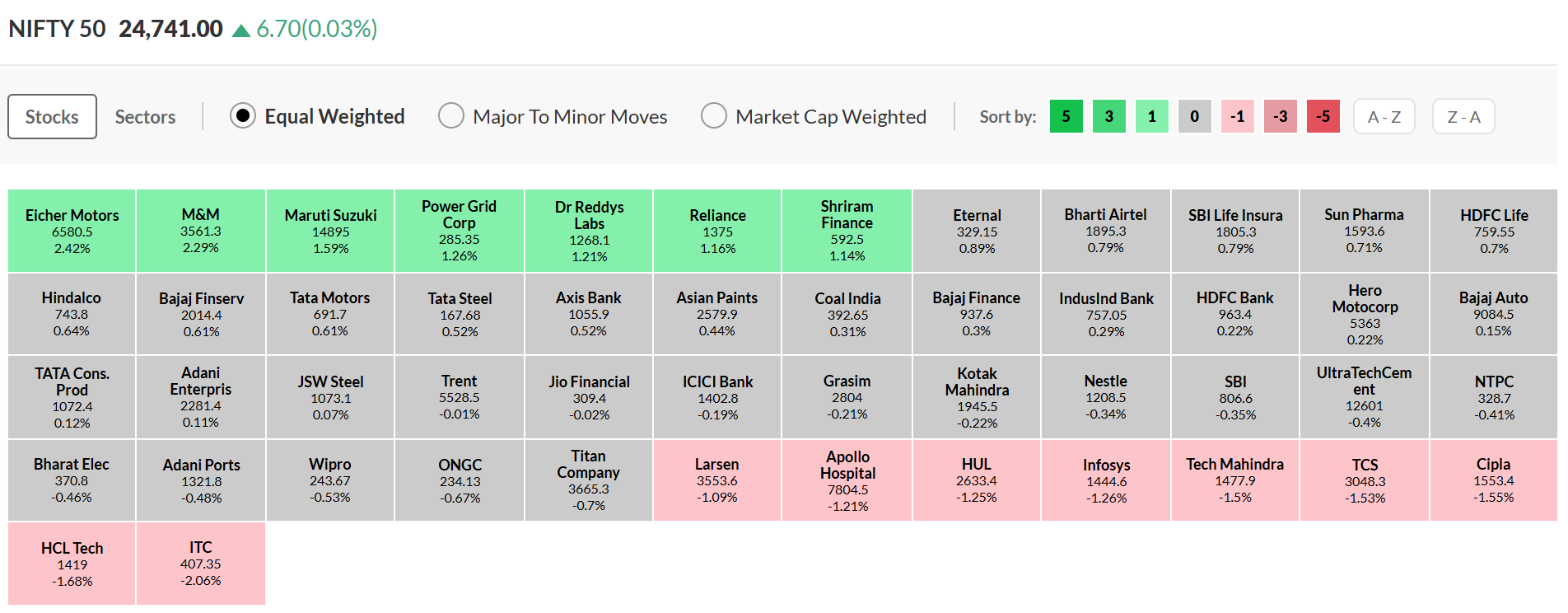

- Nifty 50: Closed almost flat at 24,741, moving only in single digits.

- Sensex: Ended at 81,744, marginally lower.

- Nifty Bank: Managed a 39-point gain, bouncing intraday from the 200-day exponential moving average (EMA) support.

Market breadth remained balanced with advancing and declining stocks nearly equal at close, underlining the absence of strong directional moves.

Market breadth: On the NSE, advances modestly outnumbered declines (roughly 2,081 vs 1,828), reflecting resilience in the broader market despite muted index moves.

Flows:

- FIIs: net sell ₹1,304.9 crore

- DIIs: net buy ₹1,821.2 crore (net market buy ~₹516 cr)

These provisional tallies fit the low-volatility, range-bound session narrative.

Sectors & movers

- Sectoral Highlights

- Autos & Metals: Continued to outperform, with names like M&M, Ashok Leyland, Maruti, Tata Steel and others holding firm.

- IT Stocks: Fell after rumors of possible U.S. tariff action on the Indian IT sector spread on social media. Though Bloomberg later clarified the report as unverified, stocks like TCS, HCL Tech, Tech Mahindra, Infosys and others closed lower.

- FMCG/Beverages: Varun Beverages fell nearly 4% after the GST Council announced a revised 40% GST on aerated drinks, up from the earlier 28% + 12% cess structure.

Policy & structural updates to watch

- GST revamp: The GST Council approved a rationalised structure with an overall 40% levy on aerated/non-alcoholic beverages (merging the earlier 28% GST + 12% cess) and several cuts on daily-use items effective September 22, 2025—a key driver behind recent sector rotations.

- Settlement holiday: Today was a RBI settlement holiday; equity/derivatives traded as usual but currency settlement was impacted—another reason volumes stayed tempered.

- Derivative expiries: BSE has aligned its weekly index derivatives expiry to Thursday (matching the Street’s dominant convention), a change implemented via circulars in late August; watch positioning/volumes as participants re-calibrate.

Corporate highlights

- SpiceJet: Reported a ₹234–₹238 crore quarterly loss with revenue ~₹1,106 crore, down ~34–36% YoY, reversing last year’s brief profit; operational challenges persist.

- LIC × Tata Elxsi: LIC disclosed incremental buys, taking its stake in Tata Elxsi to ~5.08%, as per exchange disclosures referenced in business media.

- PNC Infratech: Emerged L1 bidder for a ₹496-crore Bihar road project—incrementally positive for order-book visibility.

Global Market Check

- Gift Nifty: Hovered around 24,781, mirroring the flat local close.

- Dow Jones Futures: Down over 350 points, reflecting global caution.

- Nasdaq: Trading about 120 points lower.

Analysts noted that U.S. growth concerns, tariff-related chatter, and reliance on natural resources weighed on sentiment, with Asian markets keeping a cautious tone.

What this means for next week

With headline indices oscillating near medium-term moving averages and breadth holding up, traders will watch if domestic funds can keep absorbing FII supply while GST-linked sector churn settles. Autos/metals retain relative momentum; IT and FMCG may remain headline-sensitive to global cues and tax-pass-through clarity.

Note: This article is informational and not investment advice. Figures cited above are from exchange-/media-reported provisional data and reputable outlets on September 5, 2025; please refer to final exchange filings for any revisions.