Stock Market Update: Nifty 50 Closes Near Day’s Low, IT Sector Under Pressure

Indian equity markets ended the session on a weak note after a volatile trading day. While the morning trend hinted at positivity, the broader market slipped into selling pressure and eventually closed near the day’s low.

The Nifty 50 closed at 25,222, retreating to the exact retracement level highlighted in the morning commentary. The Bank Nifty also fell 174 points, settling near 55,285. Mid-cap and small-cap indices mirrored the weakness, with most of the selling pressure concentrated in the IT sector, following fresh concerns around H1B visa restrictions in the US.

Global Cues Remain Weak

Gift Nifty traded flat around 25,286, while European markets also hovered in a muted zone. The Dow Jones futures slipped 185 points, signaling a cautious global mood. Overall, global sentiment continues to remain subdued, with no strong positive triggers in sight.

Sector and Stock Highlights

- Adani Group stocks dominated the gainers’ list. Adani Power surged 20%, ATGL jumped nearly 19–20%, while Adani Green and Adani Enterprises also posted strong gains after regulatory clarity.

- On the losing side, Tech Mahindra, Infosys, TCS, LTI Mindtree, and other IT heavyweights faced sharp declines, driven by the US administration’s latest H1B visa-related fee hike. Reports suggest companies may have to spend up to ₹80 lakh (USD 100,000) per applicant, raising fresh concerns over hiring Indian talent.

- In the mid- and small-cap segment, Kfin Technologies (KFintech) fell 5% amid news that General Atlantic may offload 10–15% stake through block deals at a discount.

- Other laggards included Zensar, Coforge, and SolarEdge India, which saw heavy selling pressure.

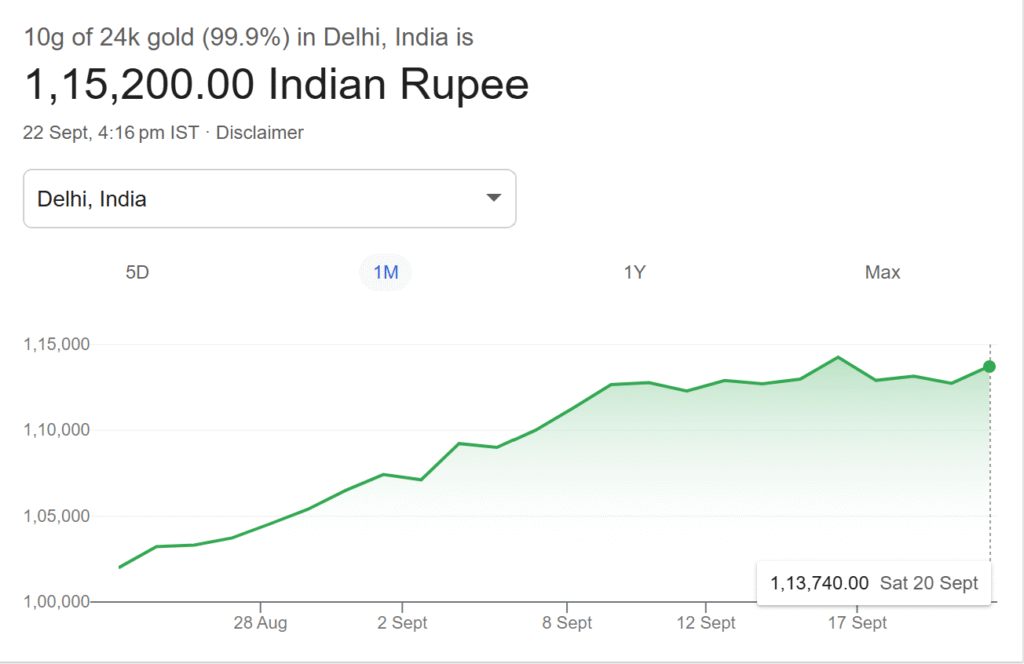

Commodities Rally

While equities struggled, gold and silver prices surged. Gold soared past ₹1,15,415.00 Indian Rupee

per 10 grams, while silver breached the ₹138 level. Analysts attribute the rally to strong festive season demand in India, coupled with global uncertainty, which is skewing the Nifty-to-Gold ratio further in favor of the precious metals.

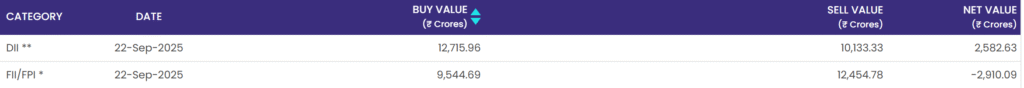

Institutional Activity

Foreign institutional investors (FIIs) continued to book profits, with net selling worth ₹2,910 crore recorded on Monday. Domestic institutional investors (DIIs) provided only marginal support with ₹26 crore in net buying, failing to counter FII pressure.

Brokerage Calls and Ratings

- JP Morgan upgraded LIC, setting a target price of ₹1,152, citing sustained growth momentum and the positive impact of GST reduction on insurance products.

- Morgan Stanley maintained a positive stance on select consumption plays.

- Motilal Oswal downgraded Voltas, assigning a target of ₹1,350, citing weaker-than-expected recovery in demand.

Market Outlook

Analysts suggest that while long-term fundamentals remain intact, short-term caution is warranted. The Nifty 50 faces a critical support level at 25,150, and a breakdown below this could trigger fresh declines. On the upside, sustained breakouts above key resistance levels are necessary for a bullish reversal.

With FIIs remaining net sellers and IT sector uncertainties weighing on sentiment, profit booking may continue in the near term. Experts advise investors to stay selective, particularly in quality IT and banking names, and to track global cues closely.