Stock Market Update: Nifty Eyes 25,000 as GST Reforms Announced

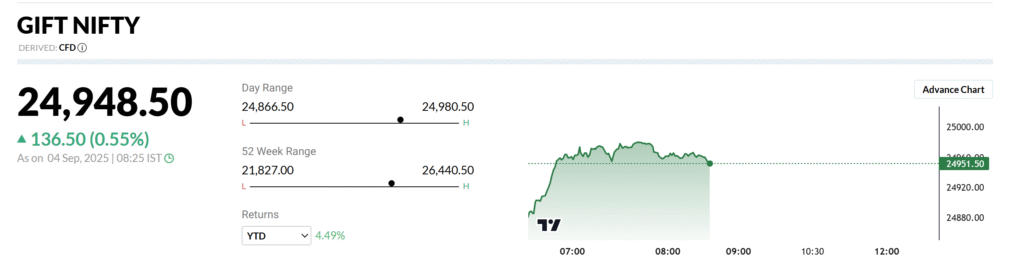

Indian markets opened on a strong note today, driven by global cues and the announcement of major GST reforms. Gift Nifty traded 165 points higher, signaling a positive start for Dalal Street.

GST Meeting Outcome

The two-day GST Council meeting concluded earlier than expected, with ministers reaching consensus on key rate revisions. The revised GST structure will come into effect from September 22, 2025, just ahead of the festive season.

- Life Insurance: GST reduced from 18% to 0%. Policyholders will no longer pay GST on premiums, though insurers may face challenges due to loss of Input Tax Credit (ITC).

- Automobiles: Small cars (below 1200cc engine capacity) will attract lower GST, benefiting companies like Maruti Suzuki.

- FMCG, Education Supplies, Electronics: Several categories saw tax cuts, aimed at boosting consumption.

Analysts believe these reforms were largely anticipated and factored into market pricing, but consumer sentiment could see a boost in the coming weeks.

Market Performance & Key Levels

On Wednesday, both Nifty 50 and Bank Nifty showed strong late-hour buying.

- Nifty 50 gained 150 points and is now approaching the 25,000 mark, with immediate support at 24,800.

- Bank Nifty closed above 54,000, opening up an upside potential of nearly 1,000 points.

Today’s closing will be crucial in determining whether Nifty can sustain above the 25,000 resistance zone.

Top Gainers & Losers

- Tata Steel (+6%), Hindalco (+3%), JSW Steel (+3%), and Coal India (+2.5%) led the rally.

- Infosys (-1.5%), HDFC Life (-1%), NTPC (-0.5%), and Wipro (-0.5%) ended lower.

Commodities & Currency Update

- Gold surged to ₹1,08,875.00 Indian Rupee

per 10 grams, while silver traded near ₹1,24,000 per kg. - Crude oil declined 3%, a positive sign for the Indian economy.

- The Indian Rupee strengthened against the US dollar but weakened against the euro, pound, and yen in Wednesday’s session.

Institutional Flows

Foreign Institutional Investors (FIIs) sold equities worth ₹1,666 crore, while Domestic Institutional Investors (DIIs) made net purchases of ₹2,495 crore.

Corporate & Sector Updates

- BHEL received a ₹2,600 crore contract for an 800 MW thermal power project in Madhya Pradesh.

- GHPL Infra bagged a ₹120 crore railway station redevelopment project.

- Prestige Estate Projects was issued a ₹161 crore GST notice.

- Zomato and Swiggy raised platform fees, sparking debate over consumer costs.

- RBL Bank entered the F&O ban list.

Outlook

With GST reforms finalized, volatility index (VIX) falling below 11, and festive demand around the corner, the investment environment appears favorable. The immediate market focus remains on whether Nifty 50 closes above 25,000, which could set the tone for the month ahead.