Gold, Silver extend gains; Nifty stays in 24,500–25,000 range. Defence, auto stocks in focus. Full weekly wrap

🟡 Gold & Silver

- Gold hit another record high at ₹1,06,539 per 10g on MCX; global safe-haven demand keeps momentum strong.

- Spot rates in Mumbai & Hyderabad hover around ₹1,08,500–₹1,08,520 per 10g.

- Silver surged near ₹1,25,000 per kg, eyeing the ₹1.5 lakh/kg milestone on strong industrial and investment demand.

📈 Nifty 50 & Bank Nifty

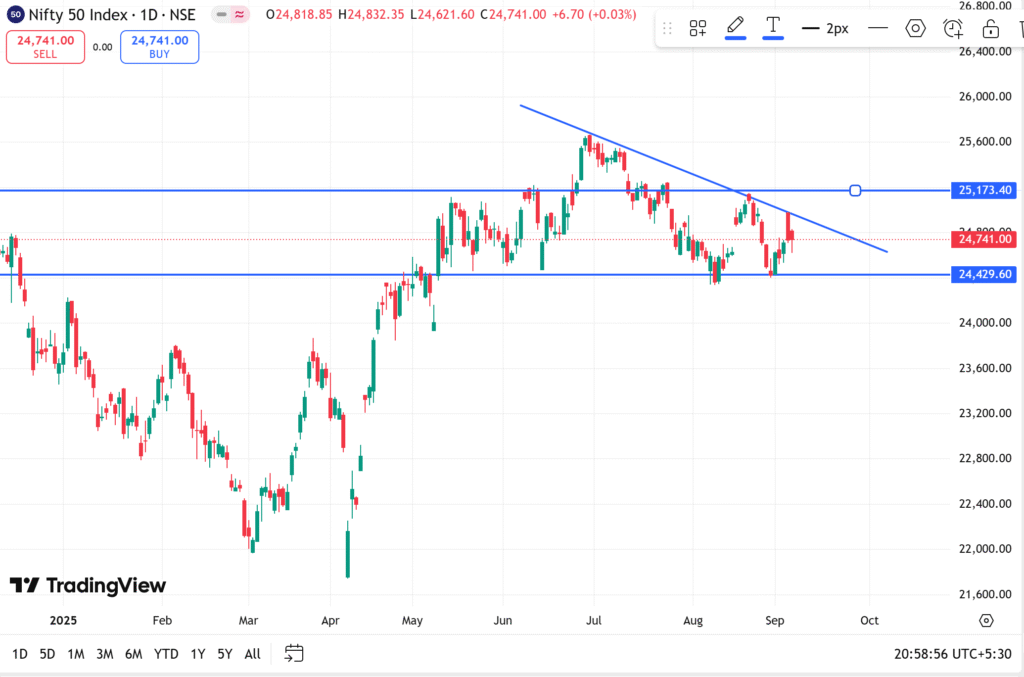

- Nifty 50 closed the week at 24,741, consolidating within the 24,500–25,000 band.

- Support: 24,400–24,500 | Resistance: 25,000.

- Bank Nifty stayed rangebound, mirroring index consolidation; investors watch for breakout cues next week.

🛢 Crude Oil

- India’s crude basket remains at its lowest levels in five years, easing inflation worries.

- Lower input costs support consumption-driven sectors.

🔑 Sector Highlights

- Defence & Aerospace: Avantel Ltd. gained over 10% this week; trades near ₹177 with rich valuations.

- Automobiles: Tata Motors trades at ₹690–₹695; Jefferies sees risk to ₹550 despite GST-led optimism.

- Consumption: Policy support and tax cuts continue to boost outlook for domestic demand plays.

📊 Quick Outlook

- Watch for Nifty’s breakout above 25,000 to confirm fresh upside.

- Bullion likely to stay strong, but investors should track overbought signals.

- Sector rotation into domestic demand themes may continue.

Disclaimer: This update is for informational purposes only and not investment advice. Please consult a registered financial advisor before trading or investing.