Weekly Market Outlook: Nifty Struggles, Precious Metals Shine; Crude Oil Impact in Focus

The Indian markets closed the week on a cautious note, with Nifty 50 and Bank Nifty facing pressure, even as gold and silver extended their bullish momentum. Meanwhile, global cues, rising crude oil prices, and India’s robust GDP growth remain in the spotlight as investors prepare for September’s trading sessions.

Global & Domestic Economic Landscape

India’s Q1 FY26 GDP came in at 7.8%, signaling resilience in the economy despite global uncertainties. However, rising crude oil prices are becoming a cause for concern, given their direct impact on India’s import bill, inflation, and currency stability.

Global markets offered mixed signals – Wall Street ended largely stable, while Asian peers struggled amid concerns over China’s economic slowdown and weak manufacturing data.

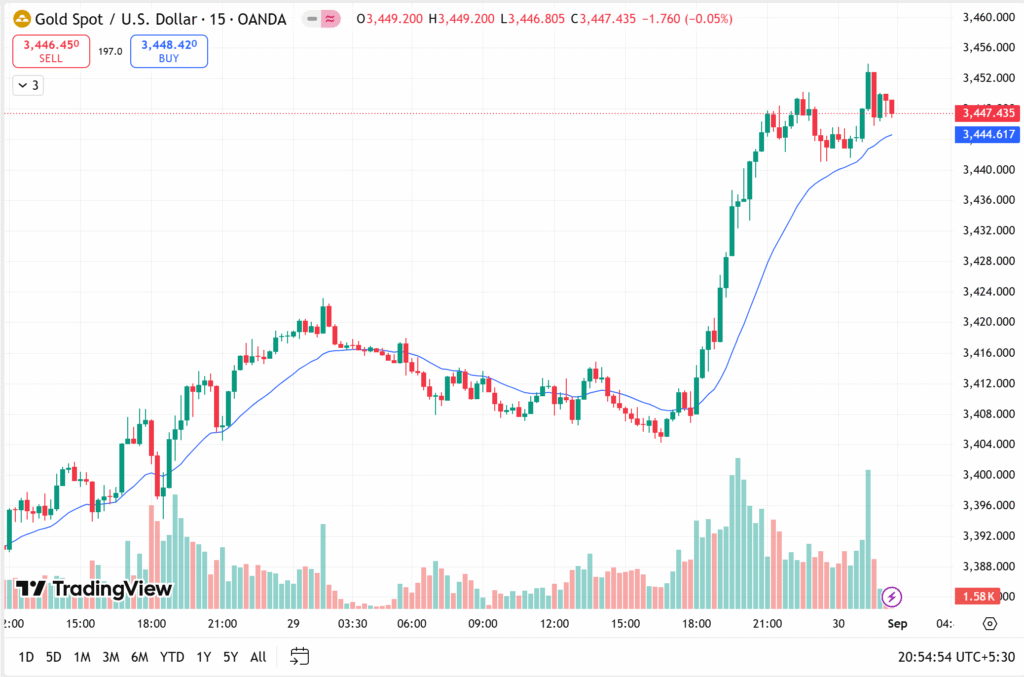

Gold and Silver: Precious Metals on Fire

Gold prices continued their strong upward trajectory, breaking past key resistance levels. Analysts suggest a clear breakout has positioned gold for further gains in the coming weeks.

Silver, however, has been the standout performer. Experts now anticipate silver prices could touch ₹1.5 lakh per kg in the medium term, fueled by robust industrial demand and global supply constraints.

Crude Oil: The India Factor

Crude oil prices remain elevated, with Brent trading firmly above the $85 mark. For India, the world’s third-largest oil importer, this spells potential challenges ahead. Rising oil could pressure the rupee, widen the fiscal deficit, and impact corporate margins in oil-dependent sectors such as paints, plastics, and logistics.

Stocks like Asian Paints, Berger Paints, and plastic manufacturers may remain under watch as crude-linked input costs rise.

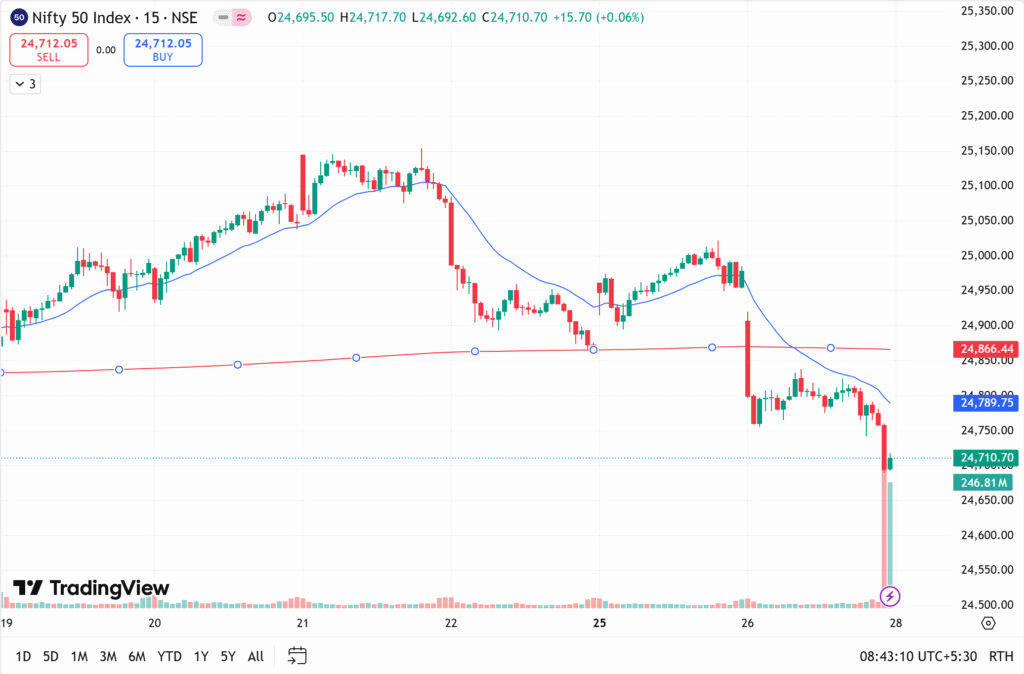

Nifty 50: Facing Resistance

The Nifty 50 index struggled to sustain momentum this week, with volatility emerging around key resistance zones. Technical analysts point out that if the index breaks below support levels, further downside cannot be ruled out.

At the same time, a decisive move above resistance could trigger fresh buying interest ahead of September’s derivatives series. Traders are advised to remain cautious with strict stop-losses in place.

Bank Nifty: Under Pressure

The Bank Nifty showed signs of weakness throughout the week, dragged by PSU and private sector banks. Rising bond yields and inflationary concerns have weighed on sentiment.

If the index breaches immediate support, analysts warn of a potential short-term correction. However, long-term fundamentals of the banking sector remain strong, supported by credit growth and stable asset quality.

Sectoral Focus: Plastics, Paints, and Titan in Spotlight

- Plastics & Paints: Vulnerable to higher crude oil prices.

- Titan Company: May benefit from strong demand for jewelry amid festive season and rising gold prices.

- IT & FMCG: Stable demand outlook, though global uncertainties could cap IT sector upside.

Outlook for the Coming Week

Markets are expected to remain volatile as traders track:

- Movement in crude oil prices

- FII/DII activity

- RBI policy stance ahead of inflation data

- Global macro indicators (US jobs data, China growth numbers)

Overall, while gold and silver remain in a strong uptrend, equity markets face resistance in the near term. Investors are advised to adopt a stock-specific approach rather than chasing index moves.